This article will give an in-depth comparison of the MT4 vs cTrader platforms. We compare differences and similarities; the user interface; charting package; trading tools; programming languages; backtesting capabilities; trade execution; availability and accessibility will allow you to assert better which trading platform is best suited for your trading needs.

Forex trading and CFD trading is a high-risk endeavour in the investment world. If you want to trade in the forex market or to speculate on the price changes of different CFDs, you need a technological software solution.

Both trading platforms cTrader and MetaTrader 4 have their pros and cons. This review will discuss everything you need to know between the most popular trading platform MetaTrader 4 and cTrader.

A Brief History

| CTRADER | METATRADER 4 | |

|---|---|---|

| Parent Company | Spotware Systems | MetaQuotes Software |

| Year Founded | 2011 | 2005 |

| Supported Markets | FX and CFDs | FX and CFDs |

| Accessibility | Windows, Mac, Web-Browser, iOS, Android, Tablets | Windows, Web-Browser, iOS, Android, Tablets |

The cTrader platform was launched in 2011 by Spotware Systems, a Fintech company headquartered in Limassol, Cyprus. On the other hand, the MetaTrader 4 (MT4) by MetaQuotes Software is the de facto standard platform in forex trading. The parent company MetaQuotes developed the MT4 trading platform in 2005.

The MT4 platform is licenced to over 1,200 brokerage trading firms, but it has stopped offering new licences to forex brokers since 2018. The MT4 was replaced by the upgraded MetaTrader 5 trading platform, which was branded as a multi-asset trading platform.

cTrader platform is an all-in-one multi-asset trading software that has more advanced trading capabilities. The depth of market (DOM) feature with level ii, ECN/STP market execution, algorithmic trading via cBots, backtesting capabilities and the order types are among the strongest points that make cTrader outshine MetaTrader 4.

Differences And Similarities

| CTRADER | METATRADER 4 | |

|---|---|---|

| Programming Languages | C# | MQL4 & MQL5 |

| One-click trading | ✔ | ✔ |

| Online community | Huge | Small |

| Built-in technical indicators | +70 | 30 |

| Experts Advisors (EAs) or trading robots | +270 | +15,000 |

| Custom indicators | +860 | +7,000 |

| Execution Model | ECN+STP | ECN |

Similarities

If we look for similarities between the two platforms in terms of features or functionality, perhaps the biggest one would be that both platforms are meant for Forex and CFD trading and not for Stock, Option or Bond trading.

Another similarity can be found in terms of platform accessibility, as both MetaTrader 4 and cTrader can be accessed from Windows PCs, mobile devices and also have web-based versions.

Also, both platforms allow algorithmic trading with the use of trading robots. MetaTrader 4’s MQL4 programming language enables traders to build and customize expert advisors, while cTrader’s equivalent, cAlgo, which is based on the C# programming language, allows for the creation of robots (cBots) to execute trades, build custom indicators, perform strategies or backtesting.

Note* To some extent MT4 users can also use the MQL5, which is now the new standard.

Yet, on the auto trading front, MetaTrader 4 is still regarded as offering the best support functionalities and it has a huge online community, where traders can easily find assistance if they need such. On the other hand, support for cTrader’s auto-trading tool may not be that widespread.

And finally, both platforms do allow one-click trading and trading directly from charts.

Differences

As for differences between the two platforms, first, we should point out that cTrader offers three options for assessing the depth of market – standard depth, price depth, and VWAP depth. These options enable traders to obtain a better view of market liquidity for different price levels and, thus, make more precise market entries. In comparison, MetaTrader 4 has only a single market depth feature.

Second, besides its richer set of technical indicators, time frames, chart types and order types, cTrader also offers advanced take-profit/stop-loss levels, market sentiment and Smart Stop-out features, while MetaTrader 4 does not. Third, the cTrader platform allows for strategy backtesting on real-time data and conducting trading performance analysis, while MetaTrader 4 does not.

Additionally, the cTrader platform allows users to customize watch lists, email and push notifications and also grants access to cloud-hosted watch lists, workspaces and price alerts, while the MT4 platform does not.

Last but not least, cTrader is designed for use with true ECN + STP brokers, while MetaTrader 4 may be appropriate only for ECN execution.

Trading Platform Interface

Comparing the user interface design, the two trading platforms have two different designs. On one hand, the MT4 platform has an outdated design, while the cTrader platform embodies a modern-looking design.

MetaTrader 4 has a neat user interface, with traders being able to view the following sections:

- Common Window Heading – contains the current account number, name of active chart window, name of the application

- Main Menu – contains all functions and commands that can be carried out in the client terminal

- Toolbars – four, built into the terminal (Standard, Charts, Line Studies, Timeframes)

- Market Watch – contains all trading instruments available

- Depth of Market – visualizes the current market for a particular trading instrument

- Data Window – contains price information as well as indicators and expert advisors applied

- Navigator – visualizes open accounts, indicators, scripts and expert advisors

- Terminal – contains multiple functions, including active trade positions, news, account history, alerts, mailbox, signals, platform and expert advisor logs

- Tester – testing of expert advisors;

- Tick Charts

- Status Bar

- Fast Navigation Tools – hotkeys, acceleration keys, fast navigation bar for working quickly with the terminal

Meanwhile, cTrader has a user-friendly interface, which allows traders to reach the most important tools and options from the platform’s main screen. The interface includes the following sections:

- Main Menu – contains the Trade, Copy, Automate, Analyse, Deposit/Withdrawal features and cTrader settings

- cTID Bar – users can switch between different live trading accounts, create a Demo account, gain access to extra links and help materials

- Account Bar – users can switch between all accounts having a link to the current cTID

- MarketWatch – allows selection of trading instruments, opening trades and creation of watch lists

- Charts

- TradeWatch – users can manage positions and orders, view history of transactions and deals, and more

- Status bar

- Instruments toolbar – users can switch between different chart modes, set price alerts, configure drawing tools and more

- Active Symbol Panel – users can place orders, gain access to Depth of Market, view market sentiment, trade statistics, leverage and more

Order Types

MetaTrader 4 allows for the use of different trade orders and has three order execution modes (instant, request, market). Traders are able to use 2 market orders (Buy, Sell), 4 pending orders (Buy Stop, Sell Stop, Buy Limit, Sell Limit), 2 stop orders (Take Profit, Stop Loss) and a Trailing Stop.

In comparison, cTrader offers a wider selection of trade orders, including market orders, stop orders (including advanced take profit and advanced stop loss), limit orders, stop-limit orders, market range, market order on open, time of the day, good till the day, one cancels the other and trailing stop.

Execution Speed

The MT4 platform’s order execution speed is about 100ms on average, but it usually depends on the brokerage and the distance to some major data centres in London, New York or Hong Kong. Some top brokerages worldwide such as Pepperstone has an MT4 execution speed of less than 30ms, while IC Markets boosts 40ms execution speed.

In comparison, the cTrader platform’s order execution speed ranges between 150 and 250 ms, but again, it depends on various factors. For example, leading brokerages such as FxPro ensure cTrader execution speed of about 50-65 ms.

Charting Package

MetaTrader 4 is equipped with basic charting software solutions and trade tools upfront for technical analysis, making it very beginner-friendly. The MT4 charting package includes:

- 4 types of charts – Bar, Line, Candlestick, Tick (real-time, with a single setting)

- 9-time frames – ranging from 1 min to 1 month

- 24 analytical objects – lines, channels, shapes, arrows, Gann and Fibonacci tools

- 30 built-in technical indicators, more than 2,000 free custom indicators and 700 paid indicators (available in the Code Base)

An unlimited number of charts can be opened simultaneously. Traders can also zoom and scroll through charts in real-time. MT4 charts are fully customizable. Users can create templates, or specified chart window parameters, which can be applied to any other chart. The elements stored in a particular template may include:

- Colour diagram

- Chart type and colour

- Chart scale

- Line studies

- Attached expert advisors with their parameters

- Applied technical indicators with their settings

- Separators of days

In comparison, cTrader provides advanced charting capabilities with a wealth of analytical tools and top-notch charts. The cTrader charting package includes:

- 9 types of charts – Bar, Line, Candlestick, Heikin-Ashi, HLC, Dot, Tick (27 settings available), Renko (19 settings available), Range-based charts (22 settings available)

- 54-time frames and 6 zoom levels for each time frame

- 33 analytical objects

- 70 built-in technical indicators and many more custom indicators created in cTrader Automate or downloaded from the cTrader Store

While both trading platforms allow trading Forex and CFDs directly from the charts, cTrader also enables users to detach charts, so that they can be used as stand-alone, tradable desktop applications across several screens. Every chart window/application contains all the customization tools and presents charts in different layout modes.

Another distinct feature of cTrader includes ChartShot – a tool that allows traders to share trading examples or technical strategies with other users. Any chart can be embedded directly into a web page or blog, or simply posted on any social media platform.

Similar to MetaTrader 4, cTrader also allows for the creation of chart templates, which can be used in the future. Traders can save up to 50 different templates, which accommodates multiple technical analysis-based trading strategies for various chart types, time frames or instruments.

With the cTrader platform, traders can also create unlimited watch lists, which can be detached and moved around the workspace for easy monitoring of prices of favourite trading instruments. Watch lists can be kept in the cloud for anywhere-anytime use.

Trading Tools And Risk Management Tools

MetaTrader 4 does not offer that much in terms of additional trading tools and plugins. The main features on this front include financial news, alerts and trading signals (copy trading).

Alerts can be set for certain trading conditions (for example, prices exceeding particular Bid or Ask levels specified by traders). In case a certain event occurs, the trading platform will notify traders by sound or by email. Additionally, users can enable sending push notifications or SMS to their mobile device.

The trading signals tool enables traders to copy the deals of other users in real-time directly into their live trading account or on a demo without leaving the platform. Traders can access a list of signal providers in the “Signals” tab of the MT4 terminal window, select a provider, subscribe to his/her trading signals and begin copy trading.

Users can choose from over 3,200 free and paid signals. Signal providers can be selected based on their trading history, the number of subscribers, growth percentage, funds under management or maximum drawdown.

Additionally, both MT4 and cTrader support hedging and netting.

cTrader Risk Management Tools

Similar to MetaTrader 4, the cTrader platform also allows for the configuration of email alerts. However, with cTrader, the range of possible alerts is much greater. Alert types available include:

- Pending orders filled

- Stop Loss and/or Take Profit orders triggered

- Stop-Out

- Deposits/Withdrawals

- 3 custom margin call alerts set at different levels

One trading feature, which we will not find on MetaTrader 4, is cTrader’s Volume Tooltip. When users select the volume of a particular trade order, the tool will present the pip value, the commission cost, and the margin required. Or, it will save them the time to test those parameters themselves.

Unlike MT4, cTrader also features an integrated Economic Calendar, so that traders can easily keep track of key volatility-triggering macro reports, political events, or central bank announcements.

Another tool that the MT4 platform lacks includes Market Sentiment. This tool presents the ratio of long versus short positions of all other trades in a particular trading instrument, placed on the cTrader platform across all supported brokerages.

Also unlike MetaTrader 4, cTrader offers two types of Stop-Out features:

- Smart Stop-Out, which will partially close the position taking on the highest amount of margin, while keeping the position and the point of entry;

- Fair Stop-Out, which will close the position, taking on the highest amount of margin entirely. This will free as much margin as possible to safeguard the positions that remain active.

If you wish to use copy trading, cTrader Copy is available. With cTrader Copy, every user can become a strategy provider and offer trading signals to followers in exchange for performance management and volume fee. Meanwhile, investors can locate and copy a suitable trading strategy with no long-term commitment. The key benefits for both investors and strategy providers are listed below.

Automated Trading And Robots

Both platforms offer very good automated trading capabilities, however, cTrader tops MetaTrader 4 due to the popularity of its programming language and more complex automated features.

Automated Forex Trading With cTrader Trading Platform

cTrader has a natively integrated algorithmic trading solution, known as cTrader Automate (or cAlgo), that supports C# coding language to create trading robots and a proprietary cTrader API. The latter is specifically created to suit the needs of Forex margin trading and includes market data, all order types, all order modification options, pre-built indicators, trading history, account, trading instruments and connectivity, which aims to ensure that as much detail is incorporated into a trading strategy as possible.

cTrader Automate features a built-in code editor, Visual Studio, with which traders can easily write the code for trading robots or indicators.

cTrader Automate also offers the so-called “plug and play” functionality, which enables traders to load a trading robot or custom indicator and click “play” to start trading instantly with no need to go through tedious installation procedures. With this functionality, cBots can be installed and run in a matter of seconds.

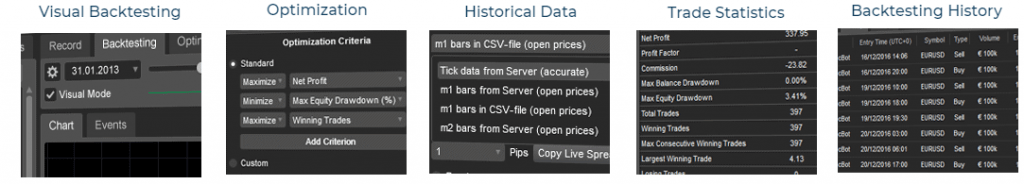

Other distinct features of cTrader Automate include:

- Visual backtesting

- Advanced optimization

- Backtesting history

- Historical data

- Trade statistics

- Deal Map

What is even more, cTrader grants access to the FIX API trading interface to any institutional, professional and high-frequency retail trader free-of-charge. Based on the FIX protocol, the API communicates directly with the cTrader server via FIX messages. The FIX protocol enables the exchange of electronic messages with financial data and is widely used in electronic trading.

cTrader FIX API allows retail clients to trade with the use of FIX messages through their cTrader trading account. It has several key advantages such as:

Last but not least, cTrader has a constantly expanding community of traders, financial experts and consultants, as well as a range of trading robots and custom indicators submitted by users in the community to support any algorithmic trading requirements.

Automated Trading With MT4 Forex Trading Platform

Perhaps one of the greatest strengths of the MT4 platform is the MQL4 Integrated Development Environment (IDE), which allows users to develop, test and use expert advisors and technical indicators for algorithmic trading. IDE’s core is the MQL4 programming language, which ensures high efficiency and functionality. IDE includes several components:

- MetaQuotes Language 4 (MQL4)

- MetaEditor

- MetaTrader 4 Strategy Tester

- Documentation – MQL4 language knowledge base

- MQL5.com – a website that grants access to unique services for financial markets trading.

Once a trading strategy has been developed in the MetaEditor, it is then moved automatically to the MT4 platform for further testing and optimization in the Strategy Tester. Finally, a compiled and tested trading strategy can be run into the platform, with the technical indicator analysing the market environment and the expert advisor – trading the particular market.

MetaTrader 4 does not only allow for strategy development, MT4 users are also able to:

- Sell their compiled trading strategy in the market (the world’s largest store of trading applications built into the platform)

- Post it in the code base where it can be downloaded free-of-charge by millions of other users. The codebase represents a free source code library containing 950 trading robots and 2,000 technical indicators and is also built into the platform

- Offer it to a customer via the platform’s Freelance service for a price. This entirely secure service is for users who have not been able to locate an appropriate trading strategy in the market or codebase

Availability And Accessibility

In terms of availability and accessibility, both platforms work across several devices including:

- A desktop version that can run on different operating systems (Windows PC and Linux)

- WebTrader is compatible with most web browsers

- Mobile App (iOS and Android devices)

- Tablets and iPad

Yet, there is a way for Linux users to run cTrader on that operating system – by using free, open-source software (known as Wine), which will enable them to run applications specifically developed for Windows. However, there have been certain issues reported by traders who use cTrader Automate (cAlgo), because Wine has no support of Windows Presentation Foundation (WPF) technology. And the majority of cTrader applications require WPF.

As for Mac users, the solution is cTrader’s web-based trading platform. We should also note that MetaTrader 4 Desktop also requires third-party software, such as Wine, to run on macOS.

cTrader vs MetaTrader 4: Web Trading

cTrader Web offers Forex traders the convenience to access the market from any device, on which an HTML5-compatible web browser is installed – Google Chrome, Mozilla Firefox, and even Safari (a good opportunity for Mac users). The web-based version of the platform is compatible with all popular operating systems and offers identical functionality for manual trading and charting with that of the desktop platform.

In comparison, the MT4 web platform also allows access to the Forex market from any browser on any operating system – Windows, Linux, Mac, without the need for extra software installation. The web version of the trading platform features all the advantages of the desktop MT4 solution and is highly secure due to data transmission encryption.

cTrader vs MetaTrader 4: Mobile Trading

cTrader applications for Android and iOS devices allow Forex traders to access their trading account from literally anywhere. The Android and iOS trading Apps have a smart design, layouts and controls. Both mobile app versions offer extensive charting capabilities, advanced order types, full trading history reports and in-app notifications regarding order status, price alerts, etc. The cTrader mobile app supports 22 languages, which extends its accessibility to a broader client base globally.

| MT4 FOR ANDROID | MT4 FOR IOS | CTRADER FOR ANDROID | CTRADER FOR IOS | |

|---|---|---|---|---|

| Rating | 4.6 out of 5 | 4.8 out of 5 | 4.4 out of 5 | ✘ |

| Reviews | +556,000 | 36,800 | 449 | ✘ |

| Size | 9.2MB | 24.1MB | 65MB | 129.7MB |

| Compatibility | Android 5.0 and up | iOS 9.0 or later | Android 4.4 and up | iOS 11.0 or later |

MetaTrader 4 also features exceptional mobile device compatibility, as it comes as a well-established platform for both iOS and Android-powered devices. The MT4 mobile app offers interactive charting, a full set of order types and technical analysis tools as well as trading history reports.

Platform Security

In terms of security, both platforms meet modern-day standards. MetaTrader 4 uses 128-bit encryption of transferred data between the client terminal and the trading platform’s servers. When it comes to cTrader security, Spotware has provided the following information:

Brokerage Availability

According to MetaQuotes Software Corp, the MT4 platform is now offered by more than 750 CFD and Forex brokers across the globe, including industry leaders such as Pepperstone, FxPro, AvaTrade, IC Markets, FP Markets and IG.

Meanwhile, Spotware has not specified how many brokerages currently offer the cTrader software solution, but still, it claims that among its “good-standing, long-term” clients are brokers such as FxPro, IC Markets and Pepperstone.

Range Of Markets Available For Trading

Although MetaTrader 4 has become the standard for Forex trading, it also supports CFDs. Along with major, minor and exotic currency pairs, traders can access CFDs on Stock Indices, Shares, Metals, Energies, Soft Commodities and Cryptocurrencies.

MT4’s successor, the MQL5-based MetaTrader 5 platform, offers a wider range of supported markets, including CFDs, Stocks, Bonds, Futures and Options. On the other hand, cTrader’s range of supported markets includes currency pairs and CFDs on Stock Indices, Metals and Energies.

Is cTrader better than MT4

While both platforms have pros and cons, overall cTrader offers superior software technology and more sophisticated trading tools than the standard MT4 platform. cTrader has a trendy user interface and tools that pertain more to day traders and scalpers, while the MetaTrader 4 platform offers a better solution for automated trading due to its big community around the development of EAs.