- Excellent Trustpilot rating of 4.6/5

- Three Unique Funding Programs

- Free Trial

- Professional Trader Dashboard

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

- No Maximum Trading Period

- No Minimum Trading Day Requirements (Except Two-step Program)

- No Maximum Daily Drawdown on One-step & No-Evaluation Programs

- Scaling Plan

- Profit Share 50% up to 100% (Depending on Challenge)

- Monthly Salary on All Funding Programs (Through Scaling)

- Overnight & Weekend Holding Allowed

- News Trading Allowed

- Balance-based Drawdown

- News trading is allowed

- Low Leverage up to 1:33 on All Funding Programs

- Mandatory Stop-loss on One-step & No-Evaluation Programs

- Minimum Trading Day Requirements with Two-step Program

- High Prices for No-Evaluation Program

City Traders Imperium encourages aspiring traders to achieve financial freedom, no matter their background or where they come from. They bring over four decades of collective experience, providing traders around the globe with unique solutions. Traders have the opportunity to earn substantial profits, with the flexibility to manage account sizes up to $100,000 and receive up to 100% profit splits. This can be accomplished through trading various financial instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Who are City Traders Imperium?

City Traders Imperium is a proprietary trading firm with the legal name CTI FZCO that was incorporated on the 13th of July, 2018. They are located in Dubai, United Arab Emirates, and are being managed by co-founders Daniel Martin and Martin Najat. City Traders Imperium provides traders with the opportunity to choose between three account types, a two-step evaluation, a one-step evaluation, and an instant funding program, while being partnered with a tier-1 liquidity provider with the best simulated real market trading conditions as their broker.

City Traders Imperium headquarters are located at Dubai Silicon Oasis, DDP, Building A2, Dubai, United Arab Emirates.

Who is the CEO of City Traders Imperium?

Daniel Martin and Martin Najat are co-founders of City Traders Imperium.

Daniel Martin is one of the co-founders of City Traders Imperium, with more than 20 years of trading experience. He has helped a wide variety of traders to become consistently profitable in their trading by focusing on the development of their trading psychology and methodology. He decided that after years of success and the achievement of financial freedom, he was not done with the markets. Instead of retiring, he committed to a new life goal of creating a global army of profitable traders.

Martin Najat, on the other hand, is the second co-founder of City Traders Imperium. He has seen major success as a Smart Money Concepts trader and has become a full-time trader after improving his trading psychology with the help of Daniel Martin.

His vision while founding City Traders Imperium was to help undercapitalized traders who lacked the amount of capital and help them change their lives. While he was working as an investment analyst in London, he soon realized that he wanted to engage in a lot more than just trading. With that, he is currently running City Traders Imperium and helping build a strong team of profitable traders.

Anyone interested in following Martin Najat can do so by following his Instagram and LinkedIn. This way, you will be able to see more of his posts and what he’s up to on a daily basis.

Video Review

Funding Program Options

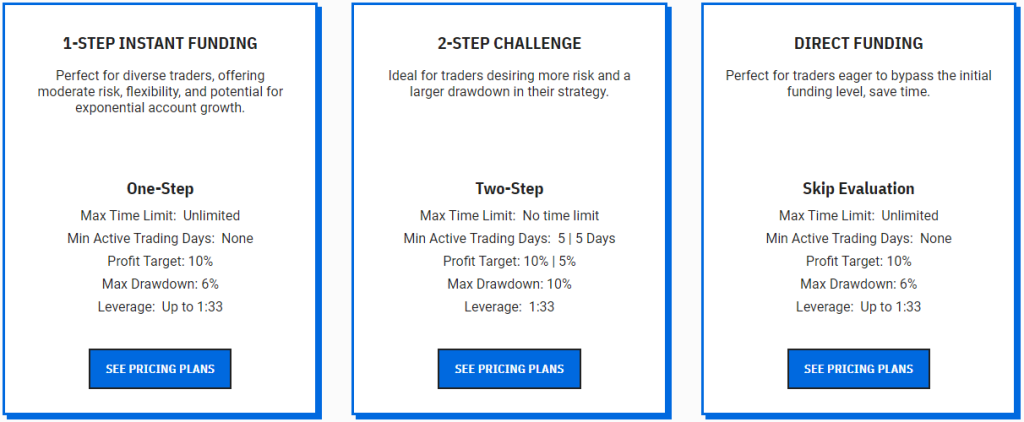

City Traders Imperium provides its traders with three unique funding program options:

- Two-step Program

- One-step Program

- No-Evaluation Program

Two-step Program

City Traders Imperium’s Two-step Program provides traders with the opportunity to manage account sizes ranging from $2,500 up to $100,000. The aim is to identify disciplined traders who are profitable and can efficiently manage risk throughout the two-step evaluation period. The Two-step Program allows you to trade with leverage up to 1:33.

| Account Size | Price |

|---|---|

| $2,500 | $39 |

| $5,000 | $59 |

| $10,000 | $99 |

| $25,000 | $179 |

| $50,000 | $329 |

| $100,000 | $519 |

Evaluation phase one requires a trader to reach a profit target of 10% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. When it comes to time limitations, note that you have no maximum trading day requirements during phase one. However, you are required to trade a minimum of five trading days in order to proceed to phase two.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. When it comes to time limitations, note that you have no maximum trading day requirements during phase two. However, you are required to trade a minimum of five trading days in order to proceed to a funded account.

By completing both evaluation phases, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 5% maximum daily loss and 10% maximum loss rules. Your first payout is after you complete 10 active days on your funded account, while all other withdrawals can be submitted on a monthly basis. Your profit split will be 80% up to 100% based on the profit you make on your funded account.

Two-step Program Scaling Plan

The Two-step Program also has a scaling plan. If a trader manages to reach a 10% profit target, which depends on the funded account scaling phase, you will be able to scale your account to the next available account size. Please note that if you decide to scale your account, you will not be required to forfeit your profits.

| Account Size | Level 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 |

|---|---|---|---|---|---|

| $2,500 | $3,750 | – | – | – | – |

| $5,000 | $7,500 | – | – | – | – |

| $10,000 | $15,000 | $20,000 | – | – | – |

| $25,000 | $37,500 | – | – | – | – |

| $50,000 | $75,000 | – | – | – | – |

| $100,000 | $112,500 | $125,000 | $150,000 | $175,000 | $200,000 |

| Profit Target | 10% | 10% | 10% | 10% | – |

| Profit Split | 80% | 80% | 80% | 90% | 100% |

Example:

The profit target for the $100,000 funded account is 10%.

Week 1: Generate a profit of 4%.

Week 2: Generate a profit of 6%.

The total generated profit from the last two weeks is 10%, which makes the account eligible for scaling since you reached the required 10% profit target.

Two-step Program Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 10%, whereas Phase 2 requires reaching a profit target of 5%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 10%.

- Minimum Trading Days – The minimum duration during which you must engage in trading before successfully concluding an evaluation phase. Both evaluation phases have a minimum trading day requirement of 5 days.

One-step Program

City Traders Imperium’s One-step Program provides traders with the opportunity to manage account sizes ranging from $4,000 up to $80,000. The aim is to identify disciplined traders who are profitable and can efficiently manage risk throughout a one-step evaluation period. The One-step Program allows you to trade with leverage up to 1:10 during the evaluation phase and up to 1:33 once funded.

| Account Size | Price |

|---|---|

| $4,000 | $59 |

| $10,000 | $149 |

| $20,000 | $299 |

| $40,000 | $499 |

| $60,000 | $749 |

| $80,000 | $999 |

The evaluation phase requires a trader to reach a profit target of 10% while not surpassing their 6% maximum loss rule. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase one. To proceed to funded status, you are only required to reach the 10% profit target without breaching the maximum loss limit rule.

By completing the evaluation phase, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 6% maximum loss rule. Your first payout is after you complete 10 active days and a profit of 2% or more on your funded account, while all other withdrawals can be submitted on a monthly basis. Your profit split will be 50% up to 100% based on the profit you make on your funded account.

One-step Program Scaling Plan

The One-step Program also has a scaling plan. If a trader manages to reach a 10% profit target, which depends on the funded account scaling phase, you will be able to scale your account to the next available account size. Please note that if you decide to scale your account, you will not be required to forfeit your profits.

| Account Size | Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 | Phase 6 | Phase 7 | Phase 8 | Phase 9 |

|---|---|---|---|---|---|---|---|---|---|

| $4,000 | $8,000 | $16,000 | $32,000 | $64,000 | $128,000 | $256,000 | $512,000 | $1,000,000 | $2,000,000 |

| $10,000 | $20,000 | $40,000 | $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – |

| $20,000 | $40,000 | $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – | – |

| $40,000 | $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – | – | – |

| $60,000 | $120,000 | $240,000 | $480,000 | $1,000,000 | $2,000,000 | – | – | – | – |

| $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – | – | – | – |

Example:

The profit target for the $10,000 funded account is 10%.

Week 1: Generate a profit of 4%.

Week 2: Generate a profit of 6%.

The total generated profit from the last two weeks is 10%, which makes the account eligible for scaling since you reached the required 10% profit target.

One-step Program Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for the evaluation phase is 10%. Funded accounts do not have any specified profit targets.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 6%.

- Stop-loss Required – Before initiating a trade, it is mandatory for the trader to place a stop-loss on each position.

No-Evaluation Program

City Traders Imperium’s No-Evaluation Program provides traders with the opportunity to manage account sizes ranging from $10,000 up to $80,000. The aim is to allow traders to skip the evaluation altogether and start earning from the start. The No-Evaluation Program allows you to trade with up to 1:33 leverage.

| Account Size | Price |

|---|---|

| $10,000 | $599 |

| $20,000 | $1,199 |

| $40,000 | $2,399 |

| $60,000 | $3,599 |

| $80,000 | $4,799 |

By purchasing the No-Evaluation Program, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 6% maximum loss rule. Your first payout is after you complete 10 active days and a profit of 2% or more on your funded account, while all other withdrawals can be submitted on a monthly basis. Your profit split will be 60% up to 100% based on the profit you make on your funded account.

No-Evaluation Program Scaling Plan

The No-Evaluation Program also has a scaling plan. If a trader manages to reach a 10% profit target, which depends on the funded account scaling phase, you will be able to scale your account to the next available account size. Please note that if you decide to scale your account, you will not be required to forfeit your profits.

| Account Size | Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 | Phase 6 | Phase 7 | Phase 8 |

|---|---|---|---|---|---|---|---|---|

| $10,000 | $20,000 | $40,000 | $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 |

| $20,000 | $40,000 | $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – |

| $40,000 | $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – | – |

| $60,000 | $120,000 | $240,000 | $480,000 | $1,000,000 | $2,000,000 | – | – | – |

| $80,000 | $160,000 | $320,000 | $640,000 | $1,000,000 | $2,000,000 | – | – | – |

The profit target for the $10,000 funded account is 10%.

Week 1: Generate a profit of 4%.

Week 2: Generate a profit of 6%.

The total generated profit from the last two weeks is 10%, which makes the account eligible for scaling since you reached the required 10% profit target.

No-Evaluation Program Trading Rules & Objectives

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 6%.

- Stop-loss Required – Before initiating a trade, it is mandatory for the trader to place a stop-loss on each position.

What Makes City Traders Imperium Different From Other Prop Firms?

City Traders Imperium differs from most industry-leading prop firms due to offering three unique account types: a two-step evaluation, a one-step evaluation, and an instant funding program. In addition, they also provide numerous favorable features, such as an unlimited trading period, no minimum trading day requirements, a balance-based drawdown, and no evaluation phases (No-Evaluation Program).

City Traders Imperium’s Two-step Program is a two-step evaluation that requires traders to successfully complete two phases before becoming eligible for payouts. The profit target is 10% in phase one and 5% in phase two, with a 5% maximum daily and 10% maximum loss rules. You also have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 5 calendar days in each evaluation phase. The Two-step Program also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Two-step Program stands out mainly for having an unlimited trading period, no minimum trading day requirements, and a balance-based drawdown.

Example of comparison between City Traders Imperium & Funding Pips

| Trading Objectives | CTI | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 100% + Monthly Salary | 80% up to 90% |

Example of comparison between City Traders Imperium & FundedNext

| Trading Objectives | CTI | FundedNext (Evaluation) |

|---|---|---|

| Phase 1 Profit Target | 10% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | 5 Calendar Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: 30 Calendar Days Phase 2: 60 Calendar Days |

| Profit Split | 80% up to 100% + Monthly Salary | 80% up to 90% |

Example of comparison between City Traders Imperium & E8 Markets

| Trading Objectives | CTI | E8 Markets |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 10% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | 5 Calendar Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 100% + Monthly Salary | 80% |

City Traders Imperium’s One-step Program is a one-step evaluation that requires traders to successfully complete a single phase before becoming eligible for payouts. The profit target is 10%, with a 6% maximum loss rule. You also have no minimum or maximum trading day requirements during the evaluation phase. The One-step Program also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the One-step Program stands out mainly for having an unlimited trading period, no minimum trading day requirements, and a balance-based drawdown.

Example of comparison between City Traders Imperium & SurgeTrader

| Trading Objectives | City Traders Imperium | SurgeTrader |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | ❌ | 5% |

| Maximum Loss | 6% | 8% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 50% up to 100% + Monthly Salary | 75% (90% with Add-on) |

Example of comparison between City Traders Imperium & Finotive Funding

| Trading Objectives | City Traders Imperium | Finotive Funding |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | ❌ | 4% |

| Maximum Loss | 6% | 7.5% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 50% up to 100% + Monthly Salary | 75% up to 95% |

Example of comparison between City Traders Imperium & Blue Guardian

| Trading Objectives | City Traders Imperium | Blue Guardian |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | ❌ | 4% |

| Maximum Loss | 6% | 6% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 50% up to 100%+ Monthly Salary | 85% |

City Traders Imperium’s No-Evaluation Program is a direct funding account that allows traders to skip the evaluation altogether and start earning from the start. There are 10 active days and a profit of 2% requirements, with a 6% maximum loss rule. You also have no minimum or maximum trading day requirements. The No-Evaluation Program also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the No-Evaluation Program stands out mainly for having an unlimited trading period, no minimum trading day requirements, a balance-based drawdown, and no evaluation phases.

Example of comparison between City Traders Imperium & Funded Trading Plus

| Trading Objectives | City Traders Imperium | Funded Trading Plus |

|---|---|---|

| Profit Target | ❌ | ❌ |

| Maximum Daily Loss | ❌ | 6% |

| Maximum Loss | 6% | 6% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 60% up to 100% + Monthly Salary | 80% up to 100% |

Example of comparison between City Traders Imperium & The5ers

| Trading Objectives | City Traders Imperium | The5ers |

|---|---|---|

| Profit Target | ❌ | 10% |

| Maximum Daily Loss | ❌ | 3% (Daily Pause) |

| Maximum Loss | 6% | 6% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 60% up to 100% + Monthly Salary | 50% up to 100% |

In conclusion, City Traders Imperium differs from other industry-leading prop firms by offering three unique account types: a two-step evaluation, a one-step evaluation, and an instant funding program. In addition, they also provide numerous favorable features, such as an unlimited trading period, no minimum trading day requirements, a balance-based drawdown, and no evaluation phases (No-Evaluation Program).

Is Getting City Traders Imperium Capital Realistic?

It is essential to evaluate the achievability of trading requirements when considering proprietary trading firms that align with your forex trading style. While a company may appear attractive with a high percentage profit split on a generously funded account, the practicality decreases if they demand substantial monthly gains with minimal maximum drawdown percentages, significantly reducing the likelihood of success. Additionally, examining time constraints is crucial, with an unlimited trading period being more advantageous as it eliminates the pressure associated with time constraints. Lastly, it is essential to acquaint yourself with all trading rules during the evaluation process and subsequent funding stages to mitigate the risk of accidentally violating your trading account terms.

- Receiving capital from the Two-step Program is realistic primarily due to its average profit targets (10% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is important to note that there are no maximum trading day requirements while having a minimum trading day requirement of 5 calendar days. Furthermore, upon successfully completing both evaluation phases, participants qualify for payouts featuring an advantageous profit split of 80% up to 100%.

- Receiving capital from the One-step Program is realistic primarily due to its average profit target of 10% coupled with the average maximum loss rule (6% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly in a day or proceed at your preferred trading pace. Furthermore, upon successfully completing the evaluation phase, participants qualify for payouts featuring an advantageous profit split of 50% up to 100%.

- Receiving capital from the No-Evaluation Program is realistic primarily due to no profit target requirements coupled with the average maximum loss rule (6% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can trade at your preferred pace. Furthermore, upon successfully generating a profit, participants qualify for payouts featuring an advantageous profit split of 60% up to 100%.

After considering all the factors, City Traders Imperium is highly recommended since you have three unique funding programs to choose from, a two-step evaluation, a one-step evaluation, and an instant funding program, which all feature realistic trading objectives and conditions for qualifying for payouts.

Payment Proof

City Traders Imperium is a proprietary trading firm that was incorporated on the 13th of July, 2018. They have a large community of traders who have reached funded status and successfully qualify for a profit split.

While working with City Traders Imperium and reaching funded status with the Two-step Program, you will be eligible to receive your first withdrawal after you complete 10 active days on your funded account. However, after your first payout, you will be eligible to receive payouts if you exceed the initial account size every 30 calendar days. Your profit split will consist of a generous 80% up to 100% based on the profit that you have generated on your funded account.

However, while working with City Traders Imperium and reaching funded status with the One-step Program or No-Evaluation Program, you will be eligible to receive your first withdrawal after you complete 10 active days and a profit of 2% or more on your funded account. However, after your first payout, you will be eligible to receive payouts if you exceed the initial account size every 30 calendar days. Your profit split will consist of a generous 50% up to 100% based on the profit that you have generated on your funded One-step Program, while the No-Evaluation Program will provide you with a generous profit split of 60% up to 100%.

When it comes to City Traders Imperium payment proof, you can find it on numerous websites. One example is Trustpilot, where their traders comment regarding their experience while working with the company as well as the process of how they successfully received payouts. Another source of payment proof for City Traders Imperium is their Discord channel and YouTube channel, where you can find numerous payout certificates and interviews of the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

Which Broker Does City Traders Imperium Use?

City Traders Imperium doesn’t trade with any of the common broker brands. They are partnered with a tier-1 liquidity provider with the best simulated real market trading conditions.

As for trading platforms, while you are working with City Traders Imperium, they allow you to trade on MetaTrader 5.

Trading Instruments

As mentioned above, City Traders Imperium is partnered with a tier-1 liquidity provider with the best simulated real market trading conditions, and they allow you to trade a wide range of trading instruments, which include forex pairs, commodities, indices, and cryptocurrencies with a leverage of up to 1:100, depending on the trading instrument that you are trading and the funding program that you are participating in.

Forex Pairs

| EUR/USD | GBP/USD | USD/JPY | USD/CAD | AUD/USD | NZD/USD |

| USD/CHF | EUR/GBP | EUR/JPY | EUR/NZD | EUR/AUD | EUR/CHF |

| EUR/CAD | GBP/CHF | GBP/JPY | GBP/AUD | GBP/NZD | GBP/CAD |

| CAD/CHF | CAD/JPY | AUD/CAD | AUD/JPY | AUD/CHF | AUD/NZD |

| CHF/JPY | NZD/JPY | NZD/CAD | NZD/CHF |

Commodities

| XAU/USD | XAG/USD | XTI/USD |

Indices

| US30 | USTEC | US500 | UK100 | DE40 |

| AUS200 | F40 | JP225 | STOXX50 | CHC50 |

| ES35 | HKCHKD | N25 | SWI20 | RUS2000 |

Cryptocurrencies

| BTC/USD | ADA/USD | ETH/USD | LTC/USD |

| SOL/USD | XRP/USD |

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

|---|---|

| FOREX | 5 USD / LOT |

| COMMODITIES | 5 USD / LOT |

| INDICES | 0.5 USD / LOT |

| CRYPTO | 0 USD / LOT |

Spread Account

To check the live spreads, log in to the trading account below.

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| MetaTrader 5 | CBT-Limited | 3220 | test3220 | Click here |

Education

City Traders Imperium provides its community with a detailed Blog with educational content, such as the following four categories:

- Funding

- Technical Analysis

- Risk Management

- Knowledge Base

Additionally, City Traders Imperium also provides traders access to the CTI Academy, which includes numerous educational courses and other educational resources useful for traders of all experience levels.

City Traders Imperium stands out as an exclusive proprietary trading firm that provides a complimentary trial option. This enables traders to familiarize themselves with the platform’s trading conditions, reducing the chance of errors when they eventually choose from the four available funding programs.

Finally, City Traders Imperium provides its clients with exclusive entry to a meticulously crafted trader dashboard. This feature elevates risk management by offering continuous access to comprehensive statistics and objectives.

Trustpilot Feedback

City Traders Imperium has gathered an excellent score on Trustpilot based on their community’s feedback.

On Trustpilot, City Traders Imperium has a large variety of their community commenting and providing positive feedback regarding their company services. The firm has achieved an impressive rating of 4.6 out of 5 from a substantial pool of 1,056 reviews. Notably, 88% of these reviews have awarded City Traders Imperium the highest rating of 5 stars.

The first comment shows that the client extensively researched various funded prop firms and ultimately chose to sign up with City Traders Imperium. They highlight the excellent services and support received even before signing up. The Instant Funding model is particularly praised as one of the best in the industry and aligns well with their circumstances. With five years of trading experience, they express confidence that City Traders Imperium is a perfect fit for their needs.

The client recently secured funding with City Traders Imperium and praises them as one of the top prop firms in the industry. They highlight the diverse challenges offered by City Traders Imperium, accommodating various trading styles and risk appetites. No issues have been encountered so far, and any concerns are promptly addressed with reasonable and efficient resolution. The commenter strongly recommends City Traders Imperium based on their positive experience.

Social Media Statistics

City Traders Imperium can also be found on numerous social media platforms.

| YouTube | 6,730 Subscribers |

| 2,600 Followers | |

| 8,732 Followers | |

| 17,700 Followers | |

| TikTok | 3,572 Followers & 443 Likes |

| Discord | 15,368 Members |

Customer Support

| Live Chat | ✅ |

| [email protected] | |

| Phone | ❌ |

| Discord | Discord Link |

| Telegram | ❌ |

| FAQ | FAQ Link |

| Help Center | ❌ |

| ❌ | |

| Messenger | ❌ |

| Supported Languages | English |

Account Opening Process

- Registration Form – Register with City Traders Imperium by filling out the registration form with your personal details and logging into the trading dashboard.

- Choose Your Account – Choose your account type.

- Choose Your Account Size – Choose your account size.

- Choose Your Payment Method & Apply Discount Code – Choose between a credit/debit card and a cryptocurrency payment method and apply our discount code CTI10% and enjoy a 10% discount. Please note that One-step Program and No-Evaluation Program have no available discounts.

Conclusion

In conclusion, City Traders Imperium is a reputable and trustworthy proprietary trading firm providing traders with an opportunity to choose between three funding programs: the Two-step Program, which is a two-step evaluation, the One-step Program, which is a one-step evaluation, and the No-Evaluation Program, which is an instant funding program.

City Traders Imperium’s Two-step Program is an industry-standard two-step evaluation that requires the completion of two phases before becoming eligible to manage a funded account and earn 80% up to 100% profit splits. Traders must reach profit targets of 10% in phase one and 5% in phase two to become successfully funded. These are realistic trading objectives, considering you have a 5% maximum daily and 10% maximum loss rules to follow. Regarding time limitations, you have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 5 calendar days in each evaluation phase. Finally, it’s essential to note that the Two-step Program features a scaling plan, providing you with the opportunity to increase your initial account balance.

City Traders Imperium’s One-step Program is a one-step evaluation that requires the completion of a single phase before becoming eligible to manage a funded account and earn 50% up to 100% profit splits. Traders must reach a profit target of 10% to become successfully funded. These are realistic trading objectives, considering you have a 6% maximum loss rule to follow. Regarding time limitations, you have no minimum or maximum trading day requirements during the evaluation phase, meaning that you can trade based on your preferred pace without any time pressure. Finally, it’s essential to note that the One-step Program features a scaling plan, providing you with the opportunity to increase your initial account balance.

City Traders Imperium’s No-Evaluation Program is a direct funding account that allows traders to skip the evaluation altogether and start earning 60% up to 100% profit splits from the start. Traders have no profit target requirements, with a 6% maximum loss rule, which are realistic trading objectives. Regarding time limitations, you have no minimum or maximum trading day requirements, meaning that you can trade based on your preferred pace without any time pressure. Finally, it’s essential to note that No-Evaluation Program features a scaling plan, providing you with the opportunity to increase your initial account balance.

I would recommend City Traders Imperium to individuals seeking a reputable proprietary trading firm that provides exceptional trading conditions catering to a diverse range of individuals with unique trading styles. They provide traders with special features, such as an unlimited trading period, no minimum trading day requirements, a balance-based drawdown, and no evaluation phases (No-Evaluation Program). After considering everything City Traders Imperium offers to traders worldwide, they are indeed a desirable choice within the prop trading industry.

Our detailed review of City Traders Imperium was last updated on 23.04.2024 at 07:55 (CE(S)T).

What are your individual opinions on City Traders Imperium and the services they offer? Do they align with the trading conditions and services you’ve been seeking?

Let us know if you enjoyed our detailed City Traders Imperium review by commenting below!

I using CTI for the last half a year and I like it soo much!

Great to hear your feedback Henry, thank you for reviewing us.

Wow funding up to 3 mio. Nicee! Will try this company next month

It is actually up to 4mil and we are looking forward to see you join our Team of traders. Thank you Dembe.

Any trader here which is with CTI more than a year?

Yes, I am more than 1 year. They are legit, payout always in a week or less

Thank you Wyatt for your feedback, we really appreciate it.

Legit!

Will join this week and share my option after

Thank you for joining our firm and we hope you are having a great experience with CTI.

Great company!

Thank you very much for your feedback, it’s much appreciated.

Wow, just noticed that you also have a video review for them, loved it!

I think I made up my mind with which company I’m going for next

Good review

very good direct funding

scaling plan has very nice potential if you are looking for long term consistency

Great review

Love how you break things down

Best scaling plan ever! Thx for review

Just noticed that their 2 step challenge has 45 days for each stage

Great rule compared to other firms 30 days

Nice review, really helpfull

very good prop firm

really like all the competitions they provide to traders

Good direct funding program

I love the fact that they have reduced their commission sizes!

Weekly payouts, incredible, they just keep delivering.